The Portfolio Center hosted the Rockstar CPA on October 4th as part of our Freelancing Tool Kit Series. Martin Kamenski, CPA proved that while income taxes cannot be avoided, they don’t have to keep you up at night.

This is a session we’ve run a few times now, and every time we fill the room. Why? Because students and alumni know enough about taxes to realize how much more there is to know. In my work with freelancers, there are a few themes I hear often:

– Wait, I have to pay taxes on my freelance work?

– Ugh, I just found out I owe $2000 in taxes for last year.

– I went to (major tax firm) and they had no idea what to do with me as an artist!

– I can deduct my supplies? Nobody told me!

Martin hit on all of these topics, from the financial implications of forming a business, to how much of your income you should set aside for taxes, why choosing the right accountant is important, and finally- deductions. The last point seemed most of interest to students.

Martin’s bottom line: if an expense is necessary for you to do business, it is deductible.

Most freelancers/self-employed individuals will agree that all successful freelancers need to have the right team around them. This means that you WILL eventually hire an accountant, you WILL hire a lawyer, you probably want to get to know a banker… Luckily there are professionals who specialize in creative entrepreneurship, and they are often willing to give you some basic pointers for free.

Check out the Rockstar blog for some free wisdom.

And join us for future Freelancing Tool Kit sessions, both in 623 S Wabash, Room 311.

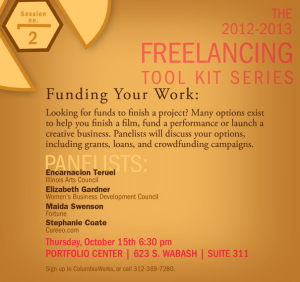

Funding Your Work: From Grants to Crowdfunding

Monday, October 15th 6:30 p.m.

Crafting Contracts

Monday, November 5th 6:30 pm